The source of funds used to acquire Murgoitio Park has been the subject of vigorous debate, and the both the City of Boise and the Airport have offered the same meaningless answer. Records show that Murgoitio Park was purchased by the Airport with Federal Aviation Authority Airport Improvement Project grants (“FAA AIP”).

Both the City and the Airport say the money came from the Airport. That doesn’t answer the question.

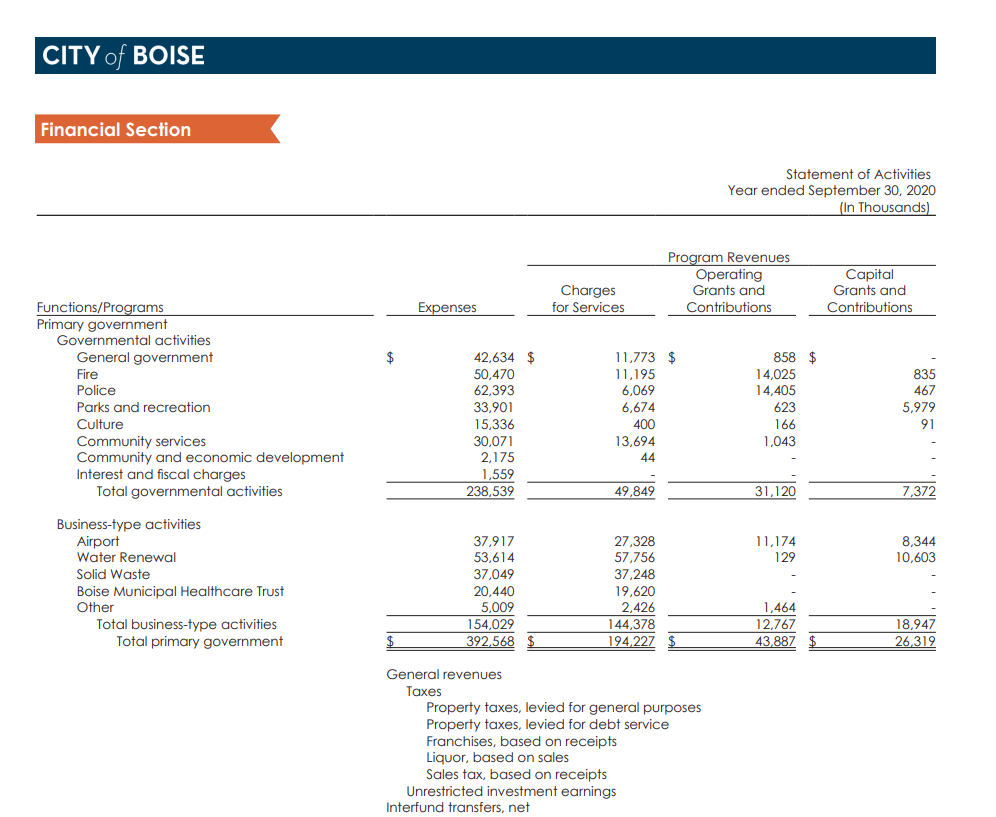

I’m a CPA and started my career auditing cities for Deloitte. Government accounting is different from business accounting. A city’s financial statements are divided into several “funds” to isolate various government functions for budgeting and reporting, and because certain funds follow different accounting rules. Like other cities, Boise’s financial statements include “governmental funds” for standard public services which are paid for with tax revenues, including funds like General Government, Fire, Police, and Parks & Recreation.

Governmental Funds. GAAP requires state and local governments to use governmental funds to account for “governmental-type activities”. Governmental-type activities include services largely funded through non-exchange revenues (taxes are the most common example). When state and local governments employ governmental fund accounting, the general fund is used to account for all financial resources of the government except for those required to be accounted for in another fund.

(U.S. Department of Housing and Urban Development, Governmental vs. Enterprise Fund Accounting, 1999.)

An “enterprise fund” is any fund that should generate a profit (“Business Type Activities”). The Boise Airport operates like a business and is an enterprise fund on the City’s financial statements. Boise’s other enterprise funds include Water Renewal, Solid Waste, and Municipal Healthcare Trust.

Enterprise Funds. GAAP requires state and local governments to use the enterprise fund type to account for “business-type activities”… similar to those found in the private sector. Business-type activities include services primarily funded through user charges. … “…to account for operations that are financed and operated in a manner similar to private business enterprises —where the intent of the governing body is that the costs of providing goods or services to the general public on a continuing basis be financed or recovered primarily through users charges,” …Moreover, it is important to note that the total cost of the activity does not have to be paid for by the user charges… [Another] governmental entity…may subsidize a significant portion of the costs of the enterprise fund.

(Ibid.) CPAs familiar with government accounting will confirm these fundamental rules. The Boise Airport is an enterprise fund, and it includes every nickel the airport collects and every nickel it spends, including FAA AIP grants.

In a KIVI story Officials: No FAA rules prevent development of the Murgoitio property, Airport business development manager Sean Briggs is quoted, “When the airport purchased that property, airport enterprise funds were used solely for the purchase, meaning no federal grant dollars were used for the purchase.” Similarly, in a BoiseDev article, “city spokesperson Bonnie Shelton said the Murgoitio site was purchased with enterprise funds, which come from the operation of the airport, not grant funds or local taxpayer dollars.”

People familiar with government accounting had the same reaction to the “enterprise funds” explanations from Briggs and Shelton: these are nonresponsive answers. It’s like telling the IRS you used money from your bank account to buy a yacht. Of course, the money came from your bank account, but how did the money get into your bank account, from selling contraband or depositing your paycheck?

Briggs’s statement is akin to stating, “funds from my bank account were used to purchase my yacht, meaning no proceeds from contraband were used for the purchase.” It’s a non sequitur and flatly wrong.

It is simply untrue that the Airport enterprise fund does not include the FAA AIP grants. FAA grants must be included in the Airport enterprise fund. If not, does the airport receive FAA money and use it to pay City police or firemen? The City’s financials specifically state that FAA grants are included in Airport Revenues:

Proprietary Funds. At the end of fiscal year 2020 net position in proprietary funds increased by $27.6 million with the Airport increasing by $10.8 million and Water Renewal increasing by $17.3 million. After the pandemic emergence in March, 2020, the Airport saw a large drop off in revenues associated with flights, rental cars, parking, and concessions. These revenues in FY 2020 came in $8.9 million less than in FY 2019, but were more than offset by an FY 2020 FAA pandemic-related grant that caused total Airport grant revenues in FY 2020 to exceed FY 2019 grant revenues by $10.6 million.

The fact that enterprise funds were used simply means that the Airport’s money was used. However, the Airport is the recipient of the FAA grants. FAA AIP grants are collected into the Airport enterprise fund. No one can seriously dispute this fact.

Saying that “enterprise funds” were used to buy the property is dodging the question. If either the City or the Airport has a meaningful response to the records we provided to the press indicating that Murgoitio Park was purchased with FAA funds, why wouldn’t they provide an answer? The absence of a real answer is telling.

The question remains unanswered by the City and Airport: “If not from FAA AIP funds, then where did the Airport get the money to buy Murgoitio Park?” The next question is “Why didn’t you give us a real answer the first two times we asked you?”

By: David King, Esq., CPA, President of Friends of Murgoitio Park

Thank you for this article. It only brings up more questions about the integrity of the current city administration. It seems that the longer this issue goes unresolved, the deeper the city becomes entangled in the matter and I’m beginning to think it will bring this administration down. When the city plays games with the public, the public is going to hold them accountable, as they should.

An audit of all the properties purchased by the City in the airport district should happen because the City is having these properties developed by Boyer and CCDC leases the property. I bet these properties were purchased with FFA funds.The City should not be in the real estate investment business making profits that go into CCDC pockets.

You should be giving this info to the appropriate division of the FAA! Kempthorne was forced to repay FAA funds when he tried to use FAA fire protection money as part of #7 fire station for residential response.

Your analogy to a bank account if good. Do rental car receipts and ramp fees go to city services like Parks?